Price variance special item types. Variance due to fx rate.

Using Budgets As Business Studies Aims Objectives Aim Understand

Using Budgets As Business Studies Aims Objectives Aim Understand

It helps the management to keep a control on its operational performance.

Currency variance analysis. This analysis is used to maintain control over a business. Sometimes a single result can be broken down into many different variances both positive and negative. Variance analysis is the quantitative i! nvestigation of the difference between actual and planned behavior.

The following analysis is created using file summary analysis making the custom file selections as shown. The sum of all variances gives a picture of the overall over performance or under performance for a particular reporting period. Also consider that the negotiated price currency is eur.

It involves the isolation of different causes for the variation in income and expenses over a given period from the budgeted standards. Constant currencies are exchange rates used by international companies to eliminate the effects of foreign currency fluctuations in financial statements. Variance analysis in managerial accounting refers to the investigation of deviations in financial performance from the standards defined in organizational budgets.

Lets go a bit detail. For each individual item companies assess its favorability by comparing actual costs. ! This item type is used to store.

An exch! ange rate variance erv occurs when the invoice for the purchased item is in a different currency than the inventory business units currency and the exchange rate between the two currencies changes between the time that you enter the purchase order and the time that you voucher the invoice. For example if you budget for sales to be 10000 and actual sales are 8000 variance analysis yields a difference of 2000. For items assigned to item type 09 price variance special the total variance excluding exchange is assigned to price for all months in the selected analysis period.

Variance analysis can be summarized as an analysis of the difference between planned and actual numbers. Assume that parity in the budget is 110 and in the actual it is 120. Volume price and exchange variance analysis in ifp provides estimates of the contributions to variances between actual and base sales values of volume price and exchange rate differences.

Varia! nce analysis ranges from simple and straightforward to sophisticated and complex. Some cost accounting systems separate variances into many types and categories. The analysis below was run in us with gbp being the baseplanning currency.

Variance analysis refers to the investigation as to the reasons for deviations in the financial performance from the standards set by an organization in its budget.

/currency_charts_-5bfc31a7c9e77c0026b61d31.jpg) Exchange Rate Risk Economic Exposure

Exchange Rate Risk Economic Exposure

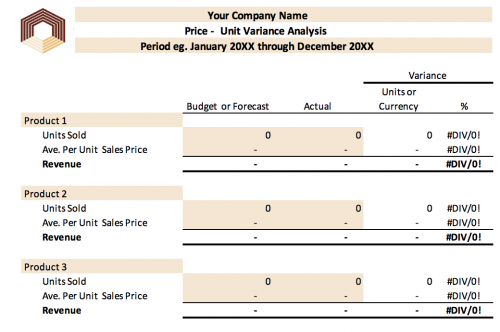

Simple Price Gross Margin And Unit Variance Analysis Tools Cfo

Simple Price Gross Margin And Unit Variance Analysis Tools Cfo

Cash Management Treasury Devisen Geldmarkt Darlehen Netting

Cash Management Treasury Devisen Geldmarkt Darlehen Netting

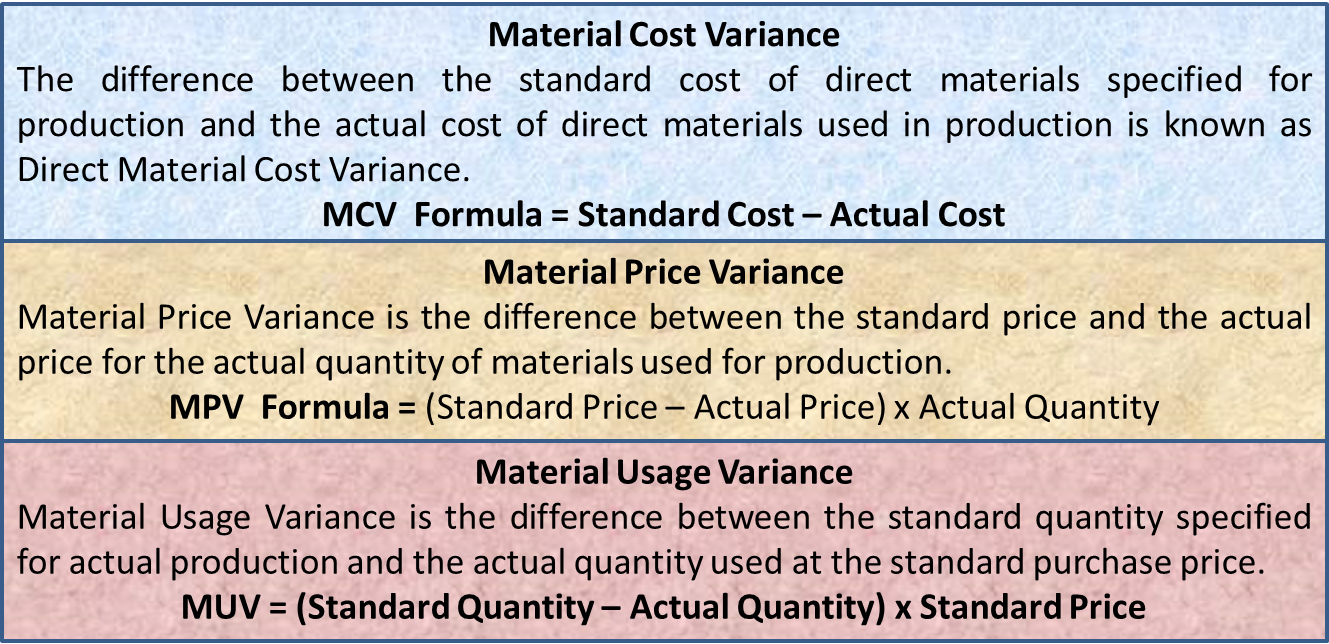

Material Variance Cost Price Usage Variance Formula Example Efm

Material Variance Cost Price Usage Variance Formula Example Efm

Removing The Impact Of Foreign Exchange Translation From Financial

Removing The Impact Of Foreign Exchange Translation From Financial

Amazon Com Mean Variance Analysis In Portfolio Choice And Capital

Amazon Com Mean Variance Analysis In Portfolio Choice And Capital

Variance Analysis

The Dollar Euro Exchange Rate 2016 2018 Vox Cepr Policy Portal

The Dollar Euro Exchange Rate 2016 2018 Vox Cepr Policy Portal

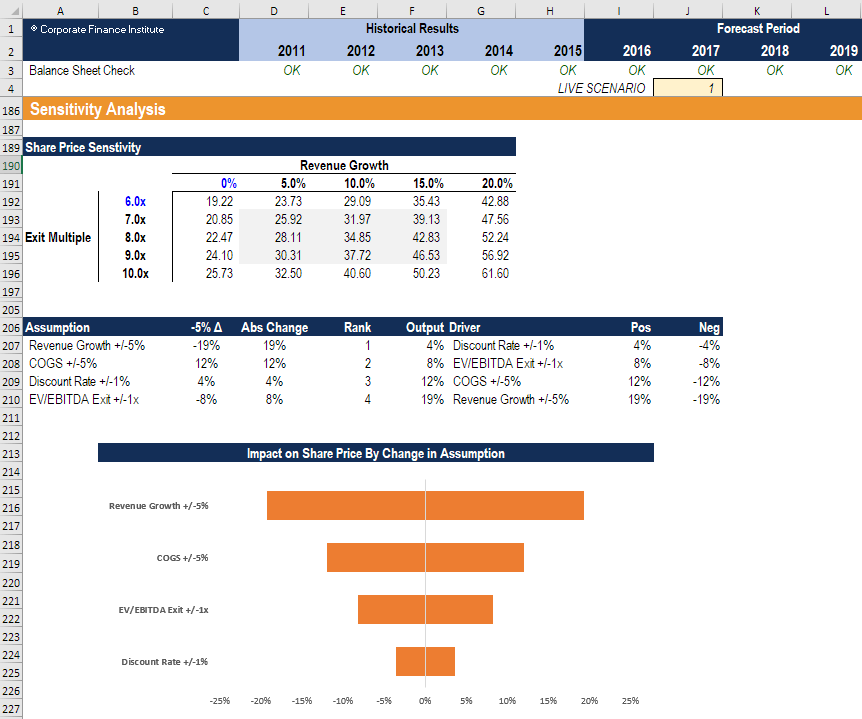

Overview Of Sensitivity Analysis What Is Sensitivity Analysis

Overview Of Sensitivity Analysis What Is Sensitivity Analysis

:brightness(10):contrast(5):no_upscale()/GettyImages-551988065-565f3c0d5f9b5833869cd689.jpg) How To Read And Calculate Currency Exchange Rates

How To Read And Calculate Currency Exchange Rates

Spot And Forward Volatility In Foreign Exchange Pdf

Spot And Forward Volatility In Foreign Exchange Pdf

Program Manual Of Masi Management Enterprise Simulation

The Currency Exposure In Your Equity Portfolio Beyond The Knee Jerk

The Currency Exposure In Your Equity Portfolio Beyond The Knee Jerk

/Exchange_Money_Conversion_to_Foreign_Currency-6cb1cfd70952479681791b77ea685d55.jpg) Reporting Currency

Reporting Currency

Price Volume Mix Analysis Understand Margin Variance To Drive Grow! th

Price Volume Mix Analysis Understand Margin Variance To Drive Grow! th

0 Response to "Currency Variance Analysis"

Posting Komentar