A core liquidity provider is an underwriter or a market maker that is a sizable holder of a given security or that facilitates the trading of the security. Liquidity is the ultimate factor any broker or white label need to look for.

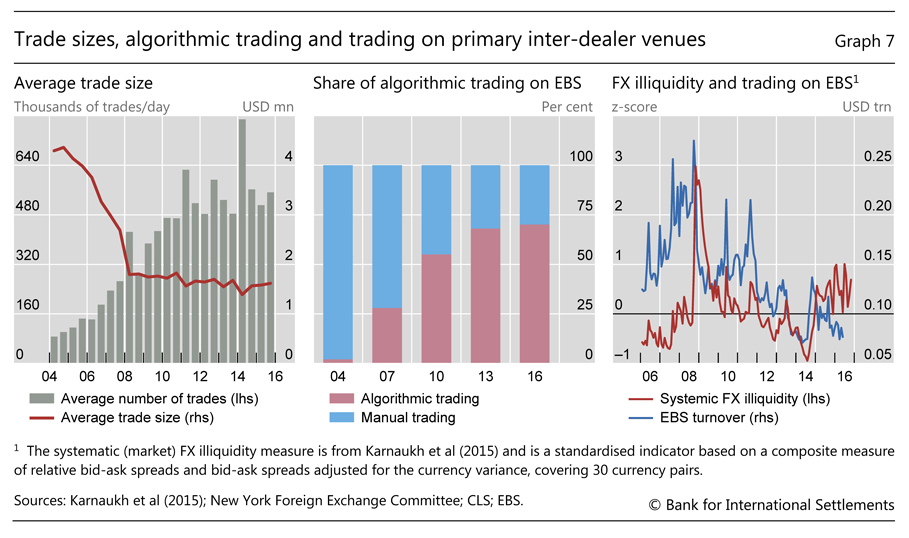

Downsized Fx Markets Causes And Implications

Downsized Fx Markets Causes And Implications

A higher liquidity is desirable for everyone as it drives down the spread and thus the cost of trading.

Forex liquidity provider definition. Deference between market makers forex t! rading brokers and stp brokers. A forex liquidity provider is an institution or individual that acts as a market maker in the foreign exchange market. Being a market maker means to act as both buyer and seller of a given asset class or exchange rate in the case of the forex market.

In forex when someone talks about liquidity providers they are generally referring to a tier 1 liquidity provider or a companyprime brokerage which has a relationship with a tier 1 liquidity provider. Once the exposure gets to big they will offload the risk to the wholesale market. Liquidity in relation to the market defines the ability of the market to purchase or sell an asset without bringing an abrupt variation in assets price.

Selecting a liquidity provider. A liquidity provider a liquidity provider connects many brokers and traders. The liquidity provider should meet high standards.

Different types of forex liquidity provider! s. The liquidity providers are the market players that are mak! ing the sale or purchase of assets. All information in urdu and hindi by tani forex.

It must be stable trusted and must have depth across multi asset instruments. More connects many brokers and traders together increasing the liquidity of the joint market. The crucial feature is also fast and reliable trade execution.

Companies specializing in liquidity solutions offered to brokers from various trading assets. Who is a liquidity provider in the forex market. In the forex market liquidity providers are often banks financial institutions and brokers also known as market.

A forex liquidity provider refers to an individual or a corporate entity that provides services of being a buyer and a seller of exchange rates in various currencies traded in the forex market. Liquidity providers these days internalise the flow and currency match. Yes liquidity providers can lose money if they price too tight or get run over b! y aggressive client algos.

Also 2nd part of this tutorial definition of liquidity providers.

Fx Pay Ico Review Read About The Forex Blockchain

Fx Pay Ico Review Read About The Forex Blockchain

The Role Of Liquidity Providers In The Currency Market Forex

The Role Of Liquidity Providers In The Currency Market Forex

Liquidity Provider Definition Fx Trading Revolution Your Free

Liquidity Provider Definition Fx Trading Revolution Your Free

Foreign Exchange

Ndd No Dealing Desk Forex Brokers Nasdaq Com

Official Aitsfx Best Forex Trading Liquidity Provider Worldwide

Official Aitsfx Best Forex Trading Liquidity Provider Worldwide

Cryptocurrency Liquidity Provider Crypto Coin Value Kentucky Warriors

Cryptocurrency Liquidity Provider Crypto Coin Value Kentucky Warriors

Mifid Ii How Many Liquidity Providers Should A Broker Have

Official Aitsfx Best Forex Trading Liquidity Provider Worldwide

Official Aitsfx Best Forex Trading Liquidity Provider Worldwide

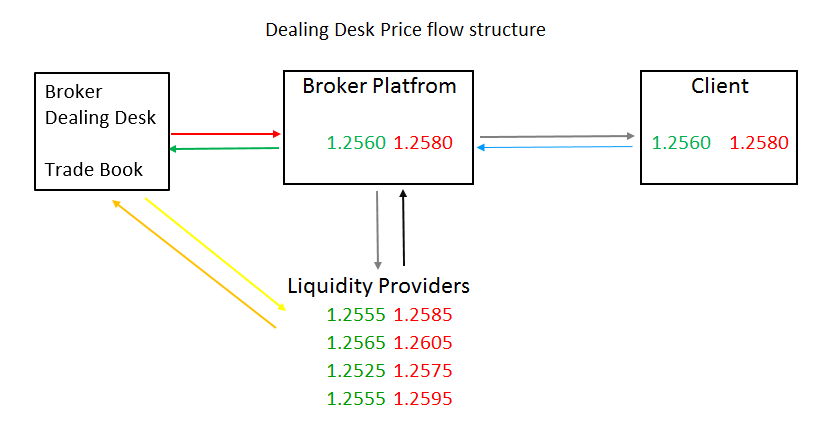

Dealing Desk Vs No Dealing Desk Broker Types Forex Training Group

Dealing Desk Vs No Dealing Desk Broker Types Forex Training Group

The Import! ance Of Liquidity In Forex Trading

The Import! ance Of Liquidity In Forex Trading

Dma Stp Forex Brokers 2019 Full Explanation Of Direct Market Access

Dma Stp Forex Brokers 2019 Full Explanation Of Direct Market Access

Cboe Plans To Introduce A New Liquidity Provider Protection Feature

Cboe Plans To Introduce A New Liquidity Provider Protection Feature

Liquidity Providers Fxcm Uk

Liquidity Providers Fxcm Uk

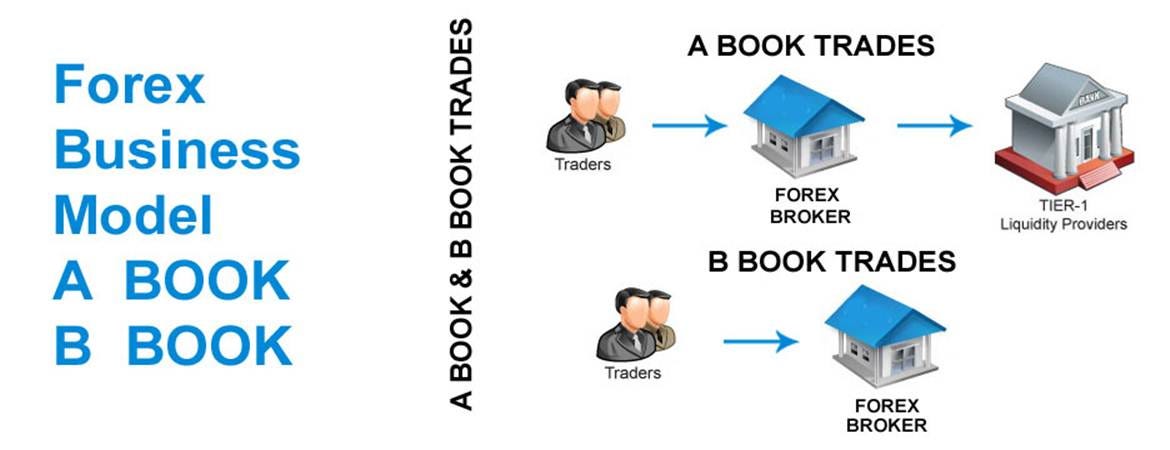

Hatchworks Spectre Ai A Booking Vs B Booking Oto Suvari Medium

Hatchworks Spectre Ai A Booking Vs B Booking Oto Suvari Medium

0 Response to "Forex Liquidity Provider Definition"

Posting Komentar